The Ultimate Guide To Offshore Company Management

Wiki Article

Rumored Buzz on Offshore Company Management

Table of ContentsWhat Does Offshore Company Management Mean?Not known Incorrect Statements About Offshore Company Management The 6-Minute Rule for Offshore Company ManagementOffshore Company Management for DummiesOffshore Company Management - Truths

The advantages of utilizing an overseas firm are that 'non-UK resident' companies are exempt from UK capital gains and likewise exempt from earnings tax obligation on make money from an abroad profession. Nevertheless, if the business is managed or taken care of from the UK, it is still classed as a UK company for the functions of UK company tax and thus the most likely additional expenditure incurred in forming and running an overseas firm can be squandered.Another factor to watch out for is where the real trading activity is maintained. If the trading task is situated offshore and the 'irreversible facility' is consequently attended be offshore, then revenues will be beyond the range of UK company tax if the monitoring as well as control is also situated offshore - offshore company management.

g. the primary investor or traders are still resident in the UK), after that the offshore firm will certainly still be assessable to UK tax on any type of income arising from this UK trade or irreversible establishment. Ultimately, on the anticipation that you as the ultimate proprietor remain a UK citizen, however you have actually handled to move the utmost administration and also control of the company offshore in addition to every one of the trading tasks, you have the extra concern of drawing the money back out of the business as well as back to the UK tax obligation successfully.

Not known Incorrect Statements About Offshore Company Management

There are additionally many various other factors to utilize an offshore vehicle: To act as an overseas holding lorry or as a candidate for 3rd parties As a special objective lorry as part of a possession financing when SPVs make good sense To hold properties in support of a trustee in countries where straight holding the possessions by the count on could be based on equivocal treatment under neighborhood legislation To insulate the dangers and incentives of certain purchases As a way of maintaining privacy To stay clear of local transfer taxes on properties by transferring the shares of the asset holding entity As an instrument for estate preparation Disclosure demands differ from place to location.

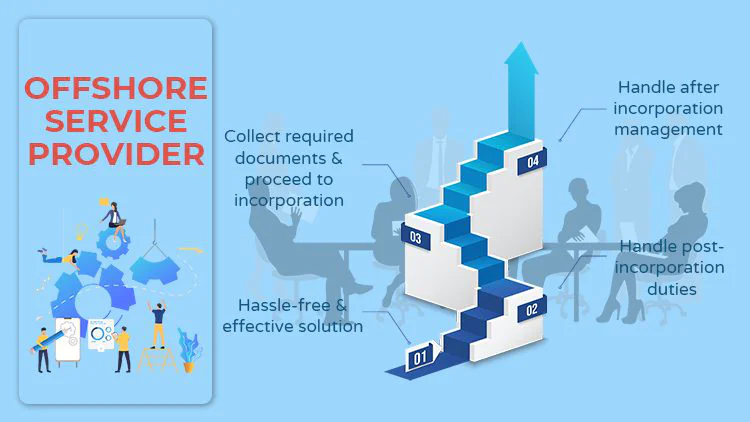

The offshore company is regulated on a daily basis by its supervisors and/or agents. Topic to home jurisdiction constraints, there is no objection to officers of the moms and dad firm being supervisors as well as having direct signature and also representative powers on behalf of the company for agreements and also the banks.

6 Simple Techniques For Offshore Company Management

An is specified as a company that is included in a territory that is various other than where the advantageous owner stays. To put it simply, an overseas firm is merely a firm that is incorporated in a nation overseas, in an international territory. An overseas business meaning, nevertheless, is not that easy and will have differing interpretations relying on the conditions.While an "onshore firm" describes a residential business that exists and functions within the boundaries of a nation, an overseas business in comparison is an entity that conducts every one of its deals outside the borders where other it is incorporated. Because it is possessed as well as exists as a non-resident entity, it is not responsible to local taxes, as every one of its monetary transactions are made outside the borders of the territory where it lies. offshore company management.

Companies that are created in such offshore jurisdictions are non-resident due to the fact that they do not perform any type of monetary purchases within their boundaries and also are had by a non-resident. Forming an overseas business outside the nation of one's very own residence includes extra defense that is discovered just when a business is integrated in a different legal system.

What Does Offshore Company Management Do?

Due to the fact that offshore business are identified as a separate legal entity it runs as a different person, unique from their proprietors or directors. This separation of powers makes a difference in between the owners as well as the firm. Any actions, financial debts, or liabilities handled by the business are not passed to its supervisors or members.While there is no single requirement through which to gauge an offshore company in all offshore territories, there are a variety of attributes and distinctions special to details financial centres that are thought about to be overseas centres. As we have actually claimed because an offshore business is a non-resident as well as performs its purchases abroad it is not bound by local corporate taxes in the country that it is incorporated.

How Offshore Company Management can Save You Time, Stress, and Money.

For even more info on finding the ideal country to form your overseas company go below. Individuals and also business choose to create an offshore company mostly for a number dig this of reasons. While there are differences in between each offshore jurisdiction, they tend to have the following similarities: Among one of the most engaging reasons to make use of an offshore entity is that when you make use of browse around here an offshore business framework it separates you from your organization in addition to properties and liabilities.

Financial purchases and service transactions would certainly then be performed the name of business instead than a single individual. A lot of overseas financial centres have business windows registries that are closed to the public which supplies discretion for directors as well as investors. All the information of the company and its accounts are closed to the general public unless there is a criminal examination.

Report this wiki page